Kenya is implementing the minimum top-up tax in line with a global effort to tackle tax avoidance by multinationals. This move follows the OECD/G20 Inclusive Framework aiming to ensure large multinational groups pay at least 15% tax in each jurisdiction where they operate.

This tax reset means minimal effective tax rates replace loopholes that used to let profits escape taxation. By aligning with international standards, Kenya protects its tax base and boosts fairness in cross-border taxation.

Who Is Affected by the Draft Regulations?

The draft regulations apply to any resident company or permanent establishment in Kenya that is part of a multinational group with a consolidated turnover of at least €750 million in at least two of the past four years before the tested income year.

Excluded entities are:

- Public entities not engaged in business;

- Pension funds;

- Real estate investment vehicles acting as ultimate parents;

- Non-operating holding companies;

- Sovereign wealth fund; and

- Intergovernmental organizations.

The draft regulations also cover complex arrangements like joint ventures, minority-owned groups, flow-through entities, and multi-parented groups to ensure comprehensive coverage.

The 15% Minimum Tax Rule: What It Means

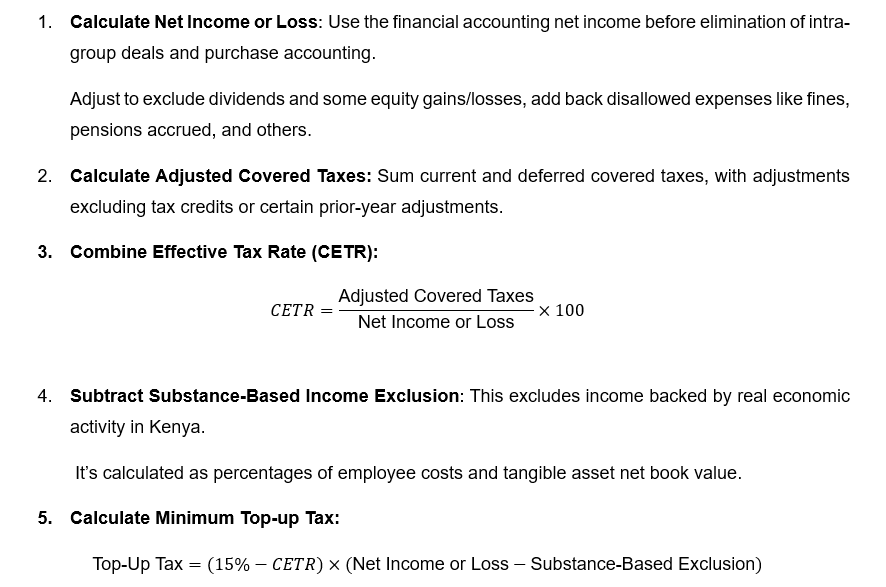

The core rule is simple: you calculate your combined effective tax rate by dividing your adjusted tax paid by your adjusted net income.

If this rate is below 15%, you pay a top-up tax to bring the effective rate up to that figure.

This is aimed at stopping MNEs from legally lowering tax bills through aggressive international tax planning or low-tax havens.

If the rate is above 15%, no additional top up tax is due.

Calculating the Minimum Top-Up Tax

Why this Matters

- The draft regulations ensure that multinationals pay a minimum level of tax in Kenya, reducing incentives for shifting profits offshore.

- This will promote tax compliance transparency via mandatory filings of the minimum top up tax returns and the GloBE information return.

- The minimum top up tax introduces an added layer of tax risk management MNEs that will have to track and report these complex computations.

- The minimum top up tax affects multinational investment and operational decisions, especially for businesses with low effective tax footprints or significant intangibles and financing structures.

Practical Checklist for MNEs

- Check if your turnover hits the €750 million threshold twice in the past 4 years.

- Gather reliable accounting net income data pre-consolidation adjustment.

- Maintain detailed employee cost and tangible asset records.

- Prepare for adjusted covered tax reconciliations, including deferred tax.

- Track deadlines for notification and MTUT/GloBE filing.

- Review intra-group financing for exclusions.

- Anticipate audit risk and ensure proper documentation.

- Coordinate with group entities on allocation and elections.

Multinational enterprises operating in Kenya face a new tax reality. The Minimum Top-Up Tax regulations demand meticulous compliance, precise calculation, and strategic tax planning and navigating this evolving landscape requires more than just compliance it demands expert guidance from advisors who understand both Kenyan specifics and the global landscape.

Intelpoint Consulting stands ready as your trusted partner in this challenge. With deep expertise in international tax, transfer pricing, and Kenyan local tax laws, we help multinationals:

- Interpret and apply the draft regulations accurately to your business model and financials.

- Calculate your combined effective tax rate and minimum top-up tax liabilities with precision.

- Design and document robust substance-based income exclusions to optimise tax outcomes lawfully.

- Prepare compliant tax filings and GloBE information returns.

- Anticipate and manage audit and enforcement risks with thoughtful strategy.

- Leverage international tax planning techniques that align with global minimum tax standards yet safeguard your competitive edge.

Contact us today to map your compliance roadmap, fortify your reporting framework, and unleash tailored international tax strategies that keep your group ahead in this new era of global taxation.

Intelpoint Consulting

info@intelpointconsulting.com

+254 714 348 150

Disclaimer: This alert is for informational purposes only and does not constitute legal or tax advice. Please contact us to discuss your specific circumstances.